More Q&A on the Proposed Settlement Trust

Thursday, June 24, 2021

Latest News

Sealaska Announces Spring Distribution of $19.2 Million

Posted 4/12/2024

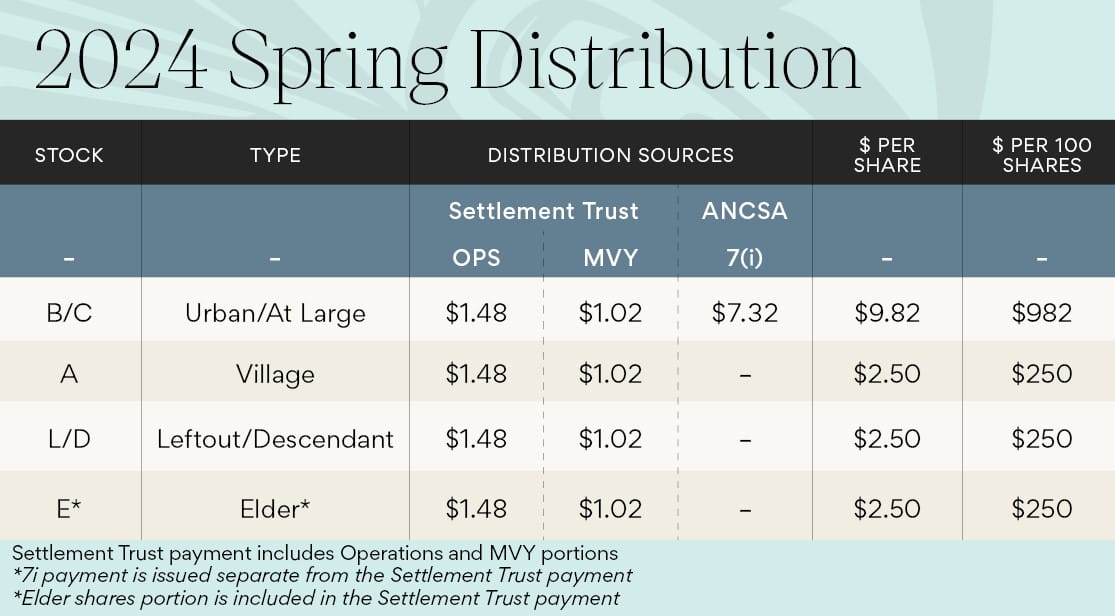

As part of Sealaska’s continued investment in our communities and region, a spring 2024 distribution totaling $19.2 million will be issued to shareholders on Thursday, April 18. Sealaska’s board of directors approved the distribution at a meeting held in Juneau on Friday, April 12. The upcoming distribution includes dividends totaling $4.5 million from Sealaska’s ocean-health business platform, $3.1 million from the Marjorie V. Young (MVY) Shareholder Permanent Fund and an additional $11.6 milli...

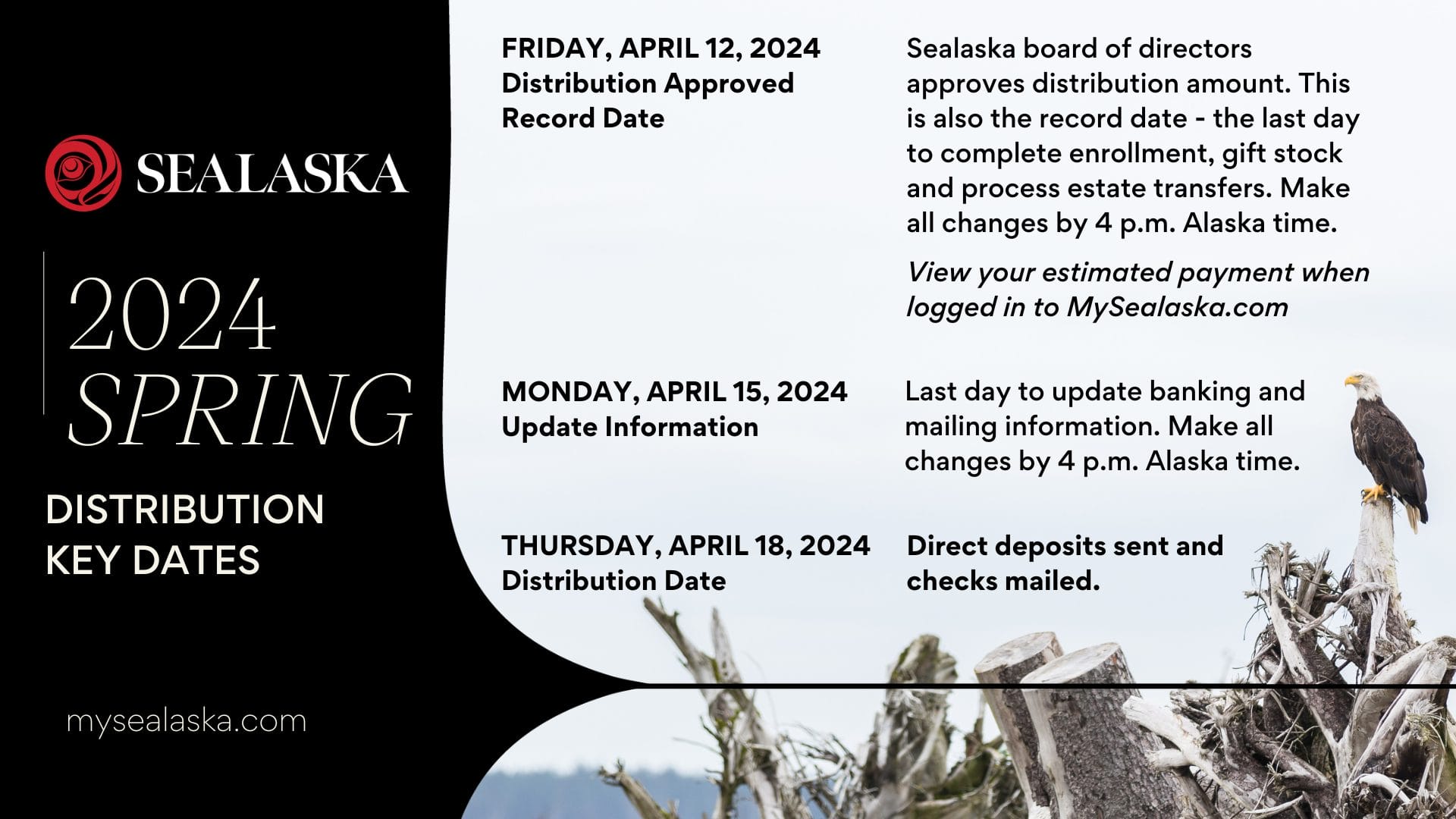

Sealaska Spring 2024 Distribution Date Announced

Posted 3/19/2024

The Sealaska Board of Directors will meet on Friday, April 12, 2024, to approve the amount for Sealaska’s 2024 spring distribution. The distribution will take place on Thursday, April 18. Shareholders can prepare for a seamless distribution by completing any enrollment or stock transfer paperwork, including gifting or inheritance, by Friday, April 12 at 4 p.m. The last day to make changes to addresses or direct deposit information is Monday, April 15, , before close of business, or online via M...

Sealaska announces Desiree Jackson to serve as Vice President of Administration and Outreach

Posted 3/6/2024

Jackson’s goals, experience are aligned with Sealaska’s vision for shareholders, communities and the region’s collective future.

A focus on strategy, values and excellence has led Desiree Anax x’aséigu yé Jackson to her new role as Sealaska’s Vice President of Administration and Outreach. Jackson has served as the executive director of...

First Quarter Board Q&A provides shareholders an opportunity to connect with their board

Posted 3/4/2024

Members of Sealaska’s board of directors had an opportunity to connect with shareholders and answer questions during the Feb. 29 board Q&A session hosted on MySealaska. Directors Barbara Cadiente Nelson, Ka’illjuus Lisa Lang joined Executive Chair Joe Nelson and Board Youth Advisor Deikeenaak’w Connor Ulmer in providing an update following January’s board meeting and shared upcoming opportunities and associated deadlines with participants. Sealaska’s language grant application period i...

Virtual Shareholder Orientation offers connection, information for original and new shareholders alike

Posted 2/26/2024

Sealaska’s Shareholder Relations team hosted a virtual shareholder orientation on Tuesday, Feb. 20 for an audience of nearly 170 shareholders from far and wide. This event offered both new and long-term shareholders a chance to learn more about the benefits and responsibilities of being a shareholder and answer questions about specific Shareholder Relations policies, procedures and protocol.

Shareholder Relations Manager Jodie Gatti, who joined the Sealaska team in November, was joined by...

The Trust Agreement is created to protect the beneficiaries and guide the trustees. The Trust Agreement requires that each trustee act in good faith, solely in the interests of the beneficiaries (shareholders), and with care, skill, prudence and diligence. Trustees are required to bring their attention, skill and focus to the job of managing the trust, just as Sealaska directors are required to act in good faith on behalf of shareholders. The Trust Agreement may be amended, but only in limited circumstances. Because the Trust is intended to last indefinitely, the agreement gives trustees the flexibility to amend the Trust as needed based on future circumstances. The Trust Agreement identifies certain types of changes that require more than “standard” approval by the appropriate body – the Board of Trustees and/or the Sealaska Corporation Board of Directors.

The Trust Agreement is created to protect the beneficiaries and guide the trustees. The Trust Agreement requires that each trustee act in good faith, solely in the interests of the beneficiaries (shareholders), and with care, skill, prudence and diligence. Trustees are required to bring their attention, skill and focus to the job of managing the trust, just as Sealaska directors are required to act in good faith on behalf of shareholders. The Trust Agreement may be amended, but only in limited circumstances. Because the Trust is intended to last indefinitely, the agreement gives trustees the flexibility to amend the Trust as needed based on future circumstances. The Trust Agreement identifies certain types of changes that require more than “standard” approval by the appropriate body – the Board of Trustees and/or the Sealaska Corporation Board of Directors.