2019 Q3 Financial Update

Wednesday, October 30, 2019

In 2018, Sealaska businesses continued to achieve record growth that allowed us to make some of the most significant philanthropic and financial investments for our communities in our corporation’s history. All indications from the 2019 performance expect us to see that trend continue (** please see forward-looking statements in the annual report). Now that we are achieving key financial goals and a stable growth path, Sealaska is more clearly able to refine our vision so that a better future for people and the planet is within reach. Sealaska’s business success is the result of this strategic vision and the company’s commitment to stick to the plan.

Sealaska’s Business Income Continues to Grow

In September 2019, directors toured Independent Packers (IPC), one of three businesses Sealaska operates under Sustainable Foods. Over the last few years, targeted investments in sustainable goods expanded to include three businesses: Orca Bay, Odyssey Foods and IPC.

In 2018, Sealaska made $65 million in net income and we expect stronger net income in

2019. We are building on our strategic vision while operating successful businesses in industries that tie to our values

Business Income

- Natural resources, environmental and water services, and food businesses are all growing year-over-year.

- Why? Having a strategic focus on ocean health keeps us disciplined in our business approach and decision-making.

Investment Income

- Strong stock markets in 2019 should allow us to show growth in investment income.

- Why? Global stock markets are up approximately 15 percent for the year and fixed income and bond markets are also up for the year.

- Investment volatility makes forecasting year-end results difficult as a downturn could happen anytime, but we are currently ahead of last year’s results.

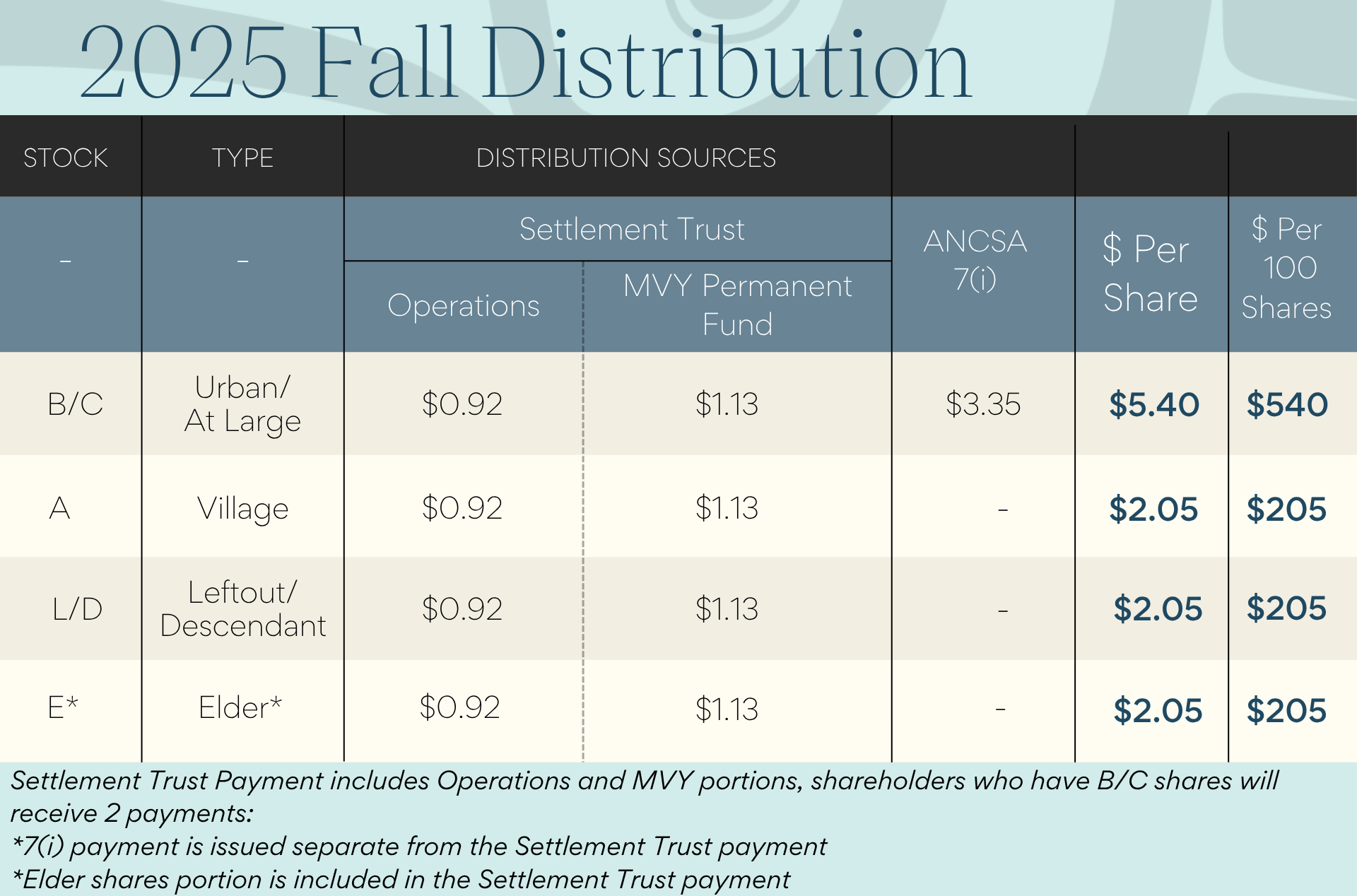

ANCSA Section 7(i)

- ANCSA Section 7(i) income has seen commodity price volatility based on the U.S.–China trade war and we may see lower 7(i) income in 2019 compared to 2018.

Our best strategy to address the ups and downs we see in ANCSA Section 7(i) and investment income is to focus on our business results and to create growth in our own operational income.

**Refer to forward-looking statements on page 25 of the 2018 annual report.

Latest News

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.