Fall 2023 Distribution Analysis

Friday, November 3, 2023

Curious about the math and analysis behind the ANCSA distributions you receive from Sealaska? Read onward to learn more.

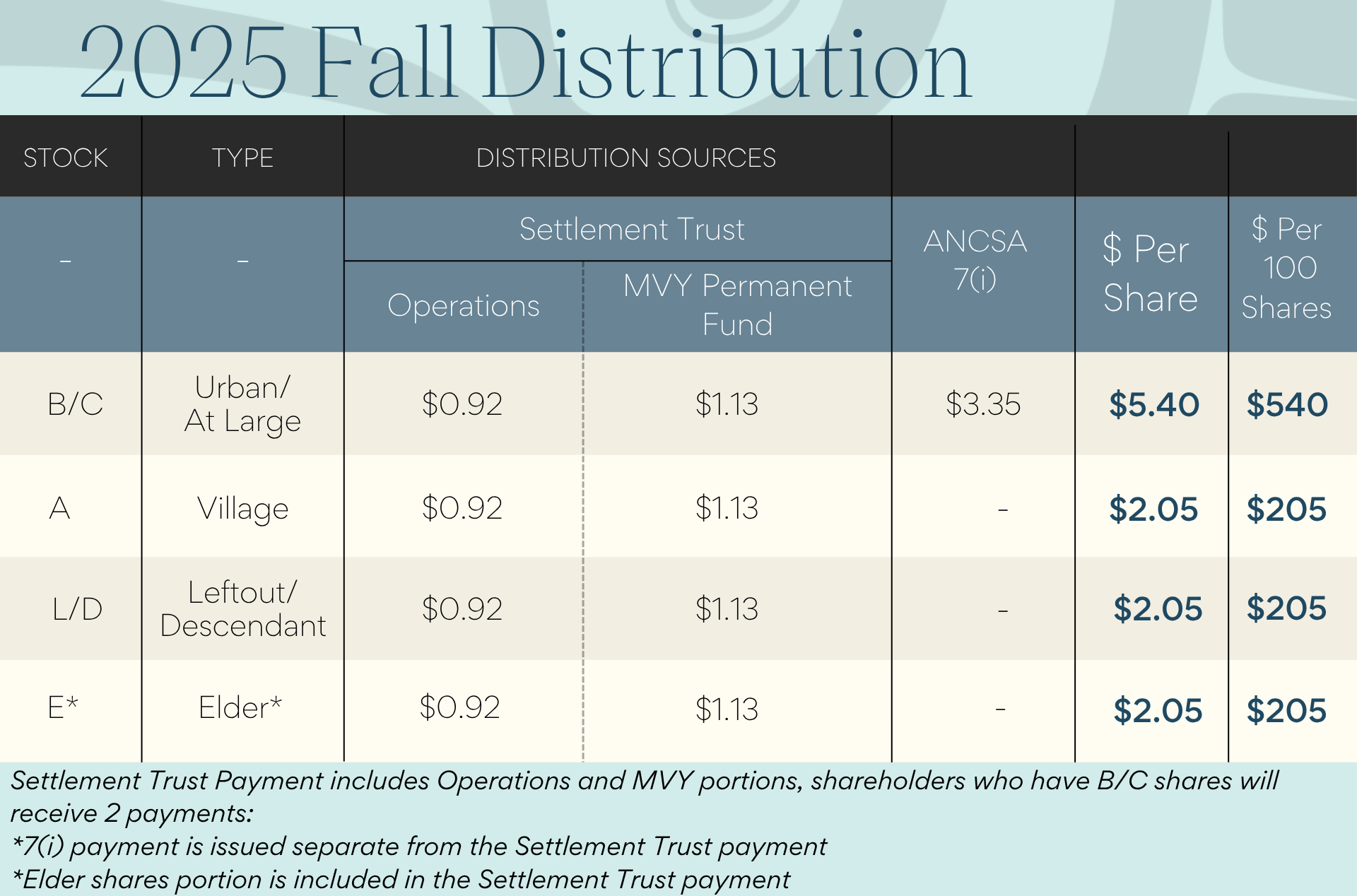

Sealaska’s fall 2023 distribution is noticeably different than the spring distribution issued earlier this year, which saw an unusually high 7(i) payment of $18 million. The large 7(i) payment seen in the spring distribution was unusual, a one-off situation not expected to be repeated. With this fall’s distribution, we see a significantly lower payout that is much more closely in line with natural resources revenue sharing from previous years. Because of this notable difference between the fall and spring distributions, we’re providing more detail on the specifics behind Sealaska’s distributions for interested shareholders, offering an opportunity for each of you to learn more about the process.

Sealaska’s distributions are impacted by three sources of income: operations, including income from carbon and our ocean-health based businesses; the Marjorie V. Young (MVY) Shareholder Permanent Fund; and 7(i) natural resources sharing revenue. Sealaska’s operating income remains strong, and we continue to see a recovery in investment income with the MVY permanent fund. This distribution is impacted by several key factors:

- Carbon income

Sealaska’s distribution policy calls for a five-year average of operations income to be included in the dividend. Sealaska began to receive large amounts of carbon income in 2018, which had a positive impact on operations income, and therefore on dividends. However, this income has begun falling out of the five-year distribution averaging equation. We have spent much of 2023 working to get a third carbon project off the ground, as well as continuing to grow our business platform. Both efforts are helping to partially offset this expected decline stemming from the absence of carbon income from the current dividend calculation. - Investment income

This portion of the dividend is very stable and driven by excellent long-term management of our investment funds, which are intended to continue providing for shareholder benefits both today and far into the future. While 2022 was an off investment year, we expect and continue to see slow, stable growth of this portion of the dividend. This helps balance the volatility seen in other areas of the distribution. - ANCSA Section 7(i) income

The 2023 fall distribution includes an ANCSA Section 7(i) payment of $3.90 per share. This is significantly lower than the spring 2023 payment of $17.76 per share, which, as indicated, represents a large, one-time payment that we do not anticipate will occur again. These 7(i) payments are the result of natural resources revenue pooled by other Alaska Native Corporations (ANCs). This includes NANA’s Red Dog Mine — the largest contributor to 7(i) statewide, which has matured and is aging out of production — as well as zinc mining and oil revenues from Arctic Slope Regional Corporation (ASRC). The per share amount for 7(i) payments is determined by a set formula outside the control of Sealaska’s board of directors.

Sealaska continues to invest in our operating businesses to decrease our reliance on those income sources over which we have less control. By building and managing businesses ourselves, we aim to generate an increasing income stream to support sustainable dividend growth, all while aggressively investing in shareholder benefit programs. Since 2015, we have more than tripled the annual amount that has been invested in programs designed to promote the education, economic and cultural benefit of our shareholders. These benefits include scholarships, internships, funding for language revitalization, and contributions to communities to promote economic resilience and cultural vitality.

To learn more about 7(i) and 7(j) and the impacts they have on ANCs like Sealaska, check out this article published by Alaska Business Monthly earlier this year: https://www.akbizmag.com/magazine/7i-and-7j/.

We also invite you to join us on Tuesday, Nov. 7 at noon Alaska time for a distribution overview and a Q&A session with members of the board. Shareholders will have the opportunity to ask questions about the most recent fall distribution and hear from directors. Join us on MySealaska.com – we look forward to seeing you there!

Latest News

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.