Fall 2023 Distribution Analysis

Friday, November 3, 2023

Curious about the math and analysis behind the ANCSA distributions you receive from Sealaska? Read onward to learn more.

Sealaska’s fall 2023 distribution is noticeably different than the spring distribution issued earlier this year, which saw an unusually high 7(i) payment of $18 million. The large 7(i) payment seen in the spring distribution was unusual, a one-off situation not expected to be repeated. With this fall’s distribution, we see a significantly lower payout that is much more closely in line with natural resources revenue sharing from previous years. Because of this notable difference between the fall and spring distributions, we’re providing more detail on the specifics behind Sealaska’s distributions for interested shareholders, offering an opportunity for each of you to learn more about the process.

Sealaska’s distributions are impacted by three sources of income: operations, including income from carbon and our ocean-health based businesses; the Marjorie V. Young (MVY) Shareholder Permanent Fund; and 7(i) natural resources sharing revenue. Sealaska’s operating income remains strong, and we continue to see a recovery in investment income with the MVY permanent fund. This distribution is impacted by several key factors:

- Carbon income

Sealaska’s distribution policy calls for a five-year average of operations income to be included in the dividend. Sealaska began to receive large amounts of carbon income in 2018, which had a positive impact on operations income, and therefore on dividends. However, this income has begun falling out of the five-year distribution averaging equation. We have spent much of 2023 working to get a third carbon project off the ground, as well as continuing to grow our business platform. Both efforts are helping to partially offset this expected decline stemming from the absence of carbon income from the current dividend calculation. - Investment income

This portion of the dividend is very stable and driven by excellent long-term management of our investment funds, which are intended to continue providing for shareholder benefits both today and far into the future. While 2022 was an off investment year, we expect and continue to see slow, stable growth of this portion of the dividend. This helps balance the volatility seen in other areas of the distribution. - ANCSA Section 7(i) income

The 2023 fall distribution includes an ANCSA Section 7(i) payment of $3.90 per share. This is significantly lower than the spring 2023 payment of $17.76 per share, which, as indicated, represents a large, one-time payment that we do not anticipate will occur again. These 7(i) payments are the result of natural resources revenue pooled by other Alaska Native Corporations (ANCs). This includes NANA’s Red Dog Mine — the largest contributor to 7(i) statewide, which has matured and is aging out of production — as well as zinc mining and oil revenues from Arctic Slope Regional Corporation (ASRC). The per share amount for 7(i) payments is determined by a set formula outside the control of Sealaska’s board of directors.

Sealaska continues to invest in our operating businesses to decrease our reliance on those income sources over which we have less control. By building and managing businesses ourselves, we aim to generate an increasing income stream to support sustainable dividend growth, all while aggressively investing in shareholder benefit programs. Since 2015, we have more than tripled the annual amount that has been invested in programs designed to promote the education, economic and cultural benefit of our shareholders. These benefits include scholarships, internships, funding for language revitalization, and contributions to communities to promote economic resilience and cultural vitality.

To learn more about 7(i) and 7(j) and the impacts they have on ANCs like Sealaska, check out this article published by Alaska Business Monthly earlier this year: https://www.akbizmag.com/magazine/7i-and-7j/.

We also invite you to join us on Tuesday, Nov. 7 at noon Alaska time for a distribution overview and a Q&A session with members of the board. Shareholders will have the opportunity to ask questions about the most recent fall distribution and hear from directors. Join us on MySealaska.com – we look forward to seeing you there!

Latest News

Exciting Opportunity at Sealaska Heritage Institute

Posted 7/11/2025SHI has an exciting position overseeing their STEAM programming and Post Secondary programming!

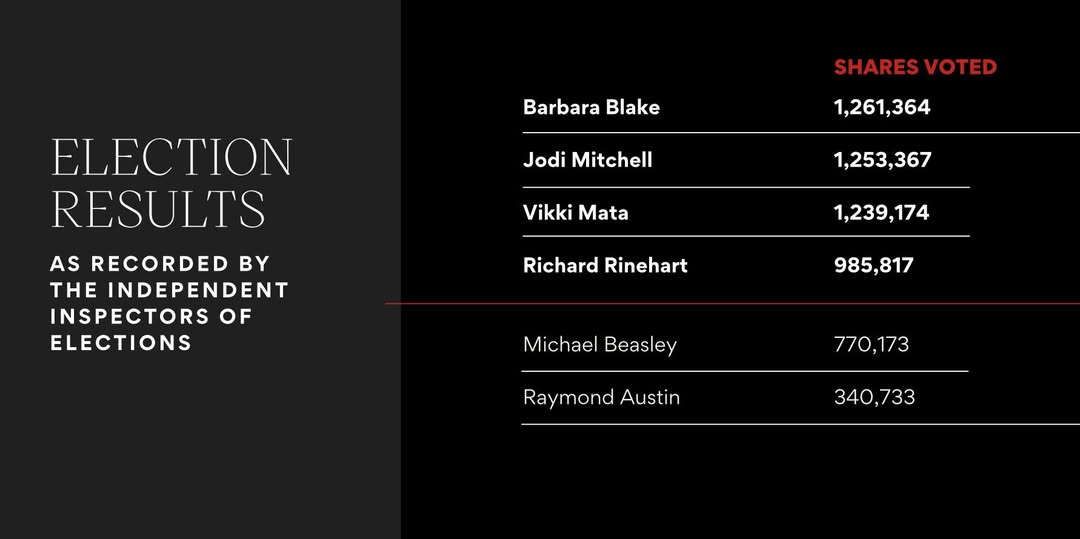

2025 Election Results

Posted 6/21/2025We are excited to announce that the results of the 2025 Sealaska election have been certified and are ready to share with all of you.

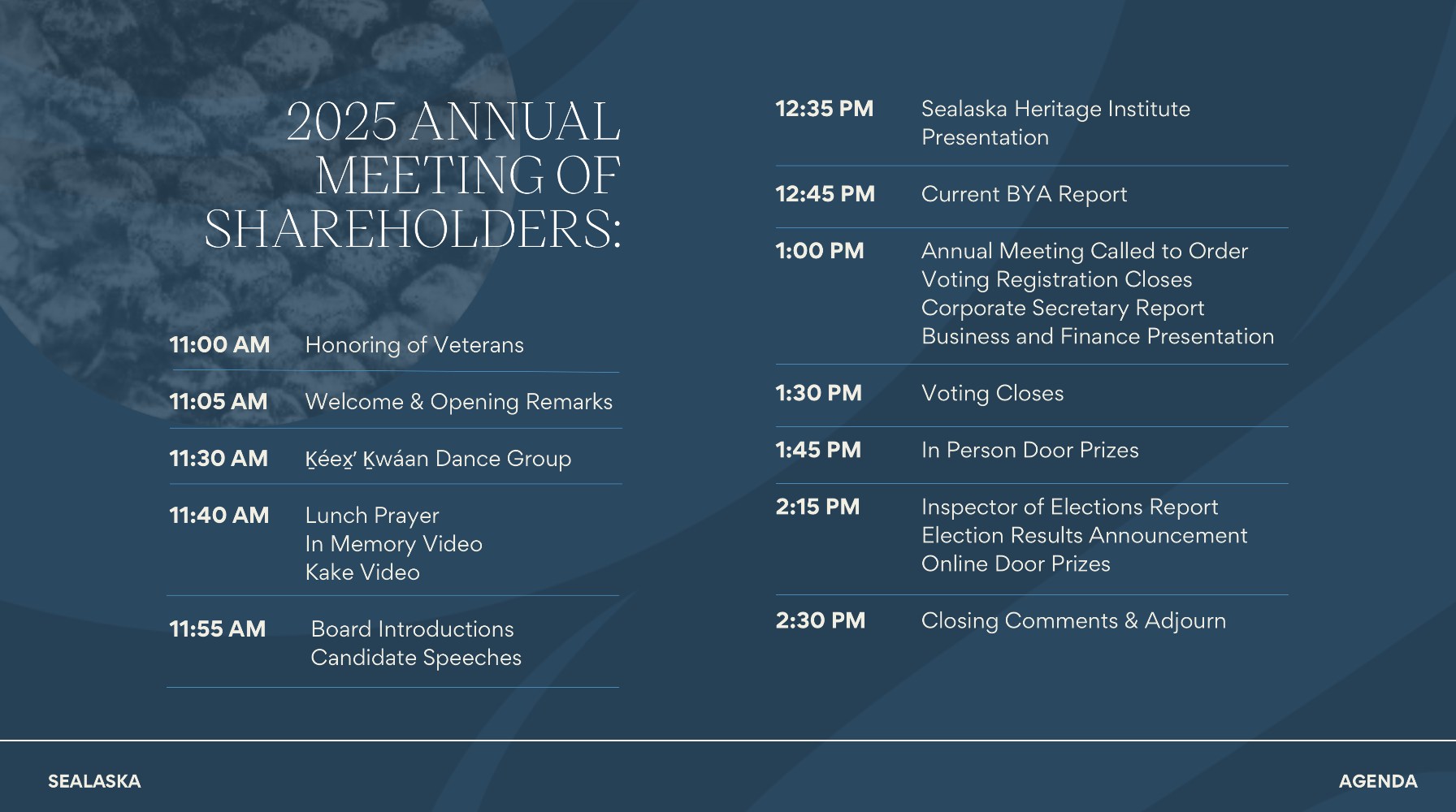

2025 Annual Meeting Agenda

Posted 6/21/20252025 Early Bird Prize Winners

Posted 6/10/2025Congratulations to our 2025 winners. At Sealaska, we are deeply grateful for your participation in this year’s election. Selecting exceptional leaders to help guide our shared future is one of the most meaningful ways for shareholders to engage with us. These winners were randomly selected from the pool of early birds by the Inspectors of Election. All payments will be processed this week and delivered via the payment method on file for distributions in MySealaska.com.

Sealaska Seeking Applicants for President

Posted 6/3/2025We are continuing our search for a dynamic and visionary leader to serve as Sealaska’s president. It is important that we find the right candidate to fill this position, which is why the Sealaska board of directors is being as exacting as possible as we search for a candidate capable of amplifying the impact of our mission and providing benefits that empower our shareholders. To this end, the Sealaska board of directors recently revised the job description for the position of president and sought the assistance of a professional recruiting firm. Our hope is to announce a successful candidate as our new president this coming summer.

.jpg)