Fall Distribution to be First from Shareholder-Approved Sealaska Settlement Trust

Thursday, October 28, 2021

Sealaska shareholders will receive their first distribution via the Sealaska Settlement Trust when the fall distribution is paid out on November 12.

Sealaska shareholders will receive their first distribution via the Sealaska Settlement Trust when the fall distribution is paid out on November 12.

The trust was created by a vote of shareholders in June, and will benefit shareholders by exempting distributions from the trust from federal tax. Many shareholders will not notice any difference between how past distributions have occurred, particularly those who are signed up for direct deposit. But there are a few subtle differences, addressed in the questions below, to be aware of.

“Settlement trusts have been widely used by Native corporations since the 1990s. They are a proven tool,” explained Sealaska President and CEO Anthony Mallott. “We are excited to roll out this new approach to distributions because we know it will bring valuable savings to our shareholders.”

Please read on to learn more about the Sealaska Settlement Trust and the changes shareholders can expect with this fall’s distribution. If your questions are not answered here, please visit this previous story about the trust for more information or email us at corpcomm@sealaska.com.

I heard about the new Sealaska Settlement Trust. Where do I sign up?

There’s no need to sign up for anything or fill out any paperwork. Shareholders retain their shares in Sealaska, and also become beneficiaries of the Sealaska Settlement Trust in equal proportion to the shares they own in Sealaska. For example, a shareholder who owns 100 shares in Sealaska will own 100 units in the Sealaska Settlement Trust. Your distributions will be paid to you as usual and the experience should be seamless.

How will the Sealaska Settlement Trust impact my distribution?

The amount of the distribution will be the same as it would have been without the settlement trust, and the process of determining the distribution is also unchanged.

- Sealaska’s board of directors meets each April and October to determine how much to pay out in a twice-yearly distribution following a defined dividend policy. (Read about how distributions are calculated here.)

- Once that announcement is made (on Friday, Oct. 29, 2021 for this fall’s distribution), shareholders will be able to view their pending payment in MySealaska.com.

- The amount approved by the board for the fall distribution will be transferred to the Sealaska Settlement Trust. This functions as a separate bank account. Payments will be made from the Sealaska Settlement Trust account instead of the Sealaska corporate account as in the past.

- On Friday, Nov. 12, payments will be processed. People who are signed up for direct deposit will receive their distribution electronically on the 12th. Checks will be mailed to shareholders who receive their distributions by mail the same day.

- In January of 2022, you’ll receive an IRS Form 1099 from Sealaska that covers the April 2021 distribution, but thanks to the Sealaska Settlement Trust, the October 2021 distribution will not be subject to federal tax. Unless you own Class B (Urban) or Class C (At-Large) shares (see below), your distributions will not appear on a Form 1099 from Sealaska after tax year 2021.

Attention Class B (Urban) and Class C (At-Large) shareholders:

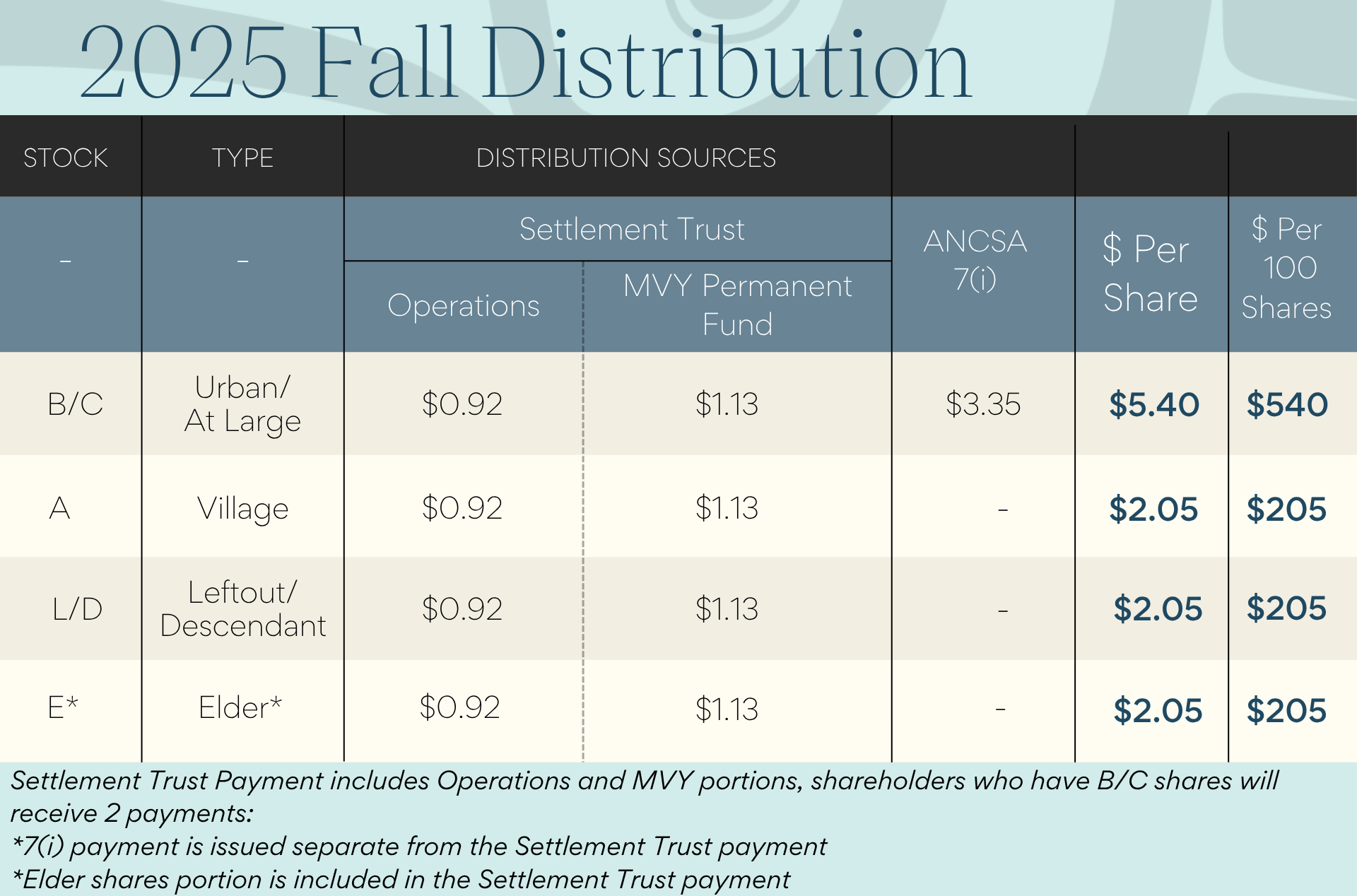

There will be some noticeable differences for owners of Class B (Urban) and Class C (At-Large) shares. Class B (Urban) and Class C (At-Large) shareholders receive Alaska Native Claims Settlement Act (ANCSA) Section 7(j) distributions directly from Sealaska (instead of from a village corporation, as is the case for Class A (Village) shareholders). Section 7(j) payments are not eligible to be transferred into the Sealaska Settlement Trust and will continue to be paid directly from Sealaska. Class B (Urban) and Class C (At-Large) shareholders will receive two separate payments from now on – distributions based on earnings from operations and the Marjorie V. Young Permanent Fund will be paid from the settlement trust; 7(j) payments will continue to be paid from Sealaska.

For Class B (Urban) and Class C (At-Large) shareholders, this means you will receive TWO direct deposits or paper checks, depending on how you receive your distributions. The direct deposits should occur one right after another, essentially simultaneously. Checks will be issued and mailed at the same time, but the mail-handling process may mean that these checks arrive on different days.

Because Class B (Urban) and Class C (At-Large) shareholders will still receive Section 7(j) payments from Sealaska, that portion of their distributions will still be considered taxable income for federal income tax purposes. You will continue to receive an IRS Form 1099 from Sealaska each January documenting these payments.

(Need a breakdown of Sealaska’s other classes of stock? Click here.)

How will the Sealaska Settlement Trust benefit me?

Distributions paid from the Sealaska Settlement Trust will not be subject to federal or most states’ income tax, which will save shareholders money and lower your overall tax burden.

Class B and Class C shareholders will still have to pay federal income tax on ANCSA Section 7(j) payments (see above).

I haven’t received my check yet – is this because of the settlement trust?

Payments from Sealaska accounts are processed out of a Wells Fargo processing center in Arizona, which Sealaska has used for the last 10 years. If your check is taking longer than usual to arrive, it could due to new, slower delivery standards for first-class mail. What used to take up to three days may now take up to five days within the United States. Checks will be mailed on November 12, so it could take an additional week to receive them. If you want to receive your distribution payments faster, please sign up for direct deposit.

My check is a lot lower than usual. I thought the Sealaska Settlement Trust was supposed to save money. What happened?

The Sealaska Settlement Trust will save shareholders money because distributions made as a result of earnings from Sealaska’s business operations and earnings on its investments will be routed through the trust and will no longer be subject to federal income tax.

If you are a Class B or Class C shareholder, though, you will probably notice that your distribution this fall is lower than normal. This has nothing to do with the Sealaska Settlement Trust. Payments from ANCSA Section 7(j) are down considerably this fall due to the impact the pandemic had on commodities prices like oil, natural gas and certain minerals. Section 7(j) payments come from the natural resources revenue earned by other Alaska Native corporations and shared collectively under ANCSA Section 7(i). With prices for resources produced by other ANCs on the decline, we can expect to see payments from ANCSA Section 7(j) decrease as well.

Latest News

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.