More Q&A on the Proposed Settlement Trust

Thursday, June 24, 2021

Throughout the election period, shareholders have asked questions about the proposed settlement trust on this year’s Sealaska proxy. A Q&A story was published in May addressing many of these questions, and answers to a few more than have come in since then are below. You can read the original story here, or click here to watch videos about the Settlement Trust for additional detail.

How does the Trust Agreement protect beneficiaries?

The Trust Agreement is created to protect the beneficiaries and guide the trustees. The Trust Agreement requires that each trustee act in good faith, solely in the interests of the beneficiaries (shareholders), and with care, skill, prudence and diligence. Trustees are required to bring their attention, skill and focus to the job of managing the trust, just as Sealaska directors are required to act in good faith on behalf of shareholders. The Trust Agreement may be amended, but only in limited circumstances. Because the Trust is intended to last indefinitely, the agreement gives trustees the flexibility to amend the Trust as needed based on future circumstances. The Trust Agreement identifies certain types of changes that require more than “standard” approval by the appropriate body – the Board of Trustees and/or the Sealaska Corporation Board of Directors.

The Trust Agreement is created to protect the beneficiaries and guide the trustees. The Trust Agreement requires that each trustee act in good faith, solely in the interests of the beneficiaries (shareholders), and with care, skill, prudence and diligence. Trustees are required to bring their attention, skill and focus to the job of managing the trust, just as Sealaska directors are required to act in good faith on behalf of shareholders. The Trust Agreement may be amended, but only in limited circumstances. Because the Trust is intended to last indefinitely, the agreement gives trustees the flexibility to amend the Trust as needed based on future circumstances. The Trust Agreement identifies certain types of changes that require more than “standard” approval by the appropriate body – the Board of Trustees and/or the Sealaska Corporation Board of Directors.

How is the Trust a vehicle for shareholder distributions and other shareholder benefits?

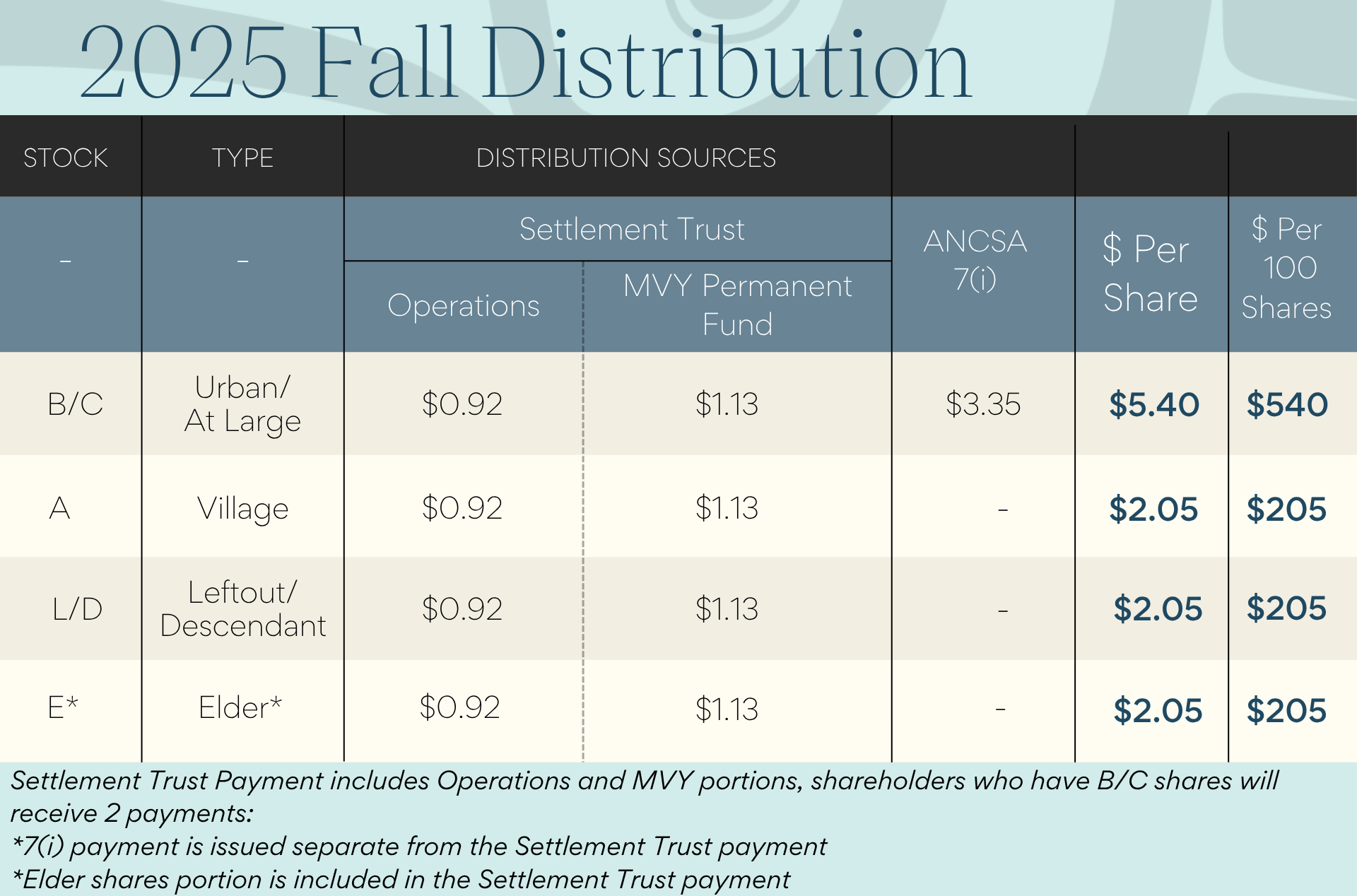

ANCSA statutes provide for the creation of settlement trusts by Alaska Native Corporations. The federal tax code provides significant benefits to the sponsoring Alaska Native Corporation as well as the settlement trust and its beneficiaries. Once Sealaska establishes the trust, shareholders will not pay any federal tax on distributions that are passed through the trust. In addition, Sealaska Corporation receives federal tax benefits that will reduce what it is required to pay in taxes. Today, when Sealaska’s board of directors determines the amount to be distributed as dividends in our twice-yearly distributions, the money is sent directly to shareholders. With the trust, the money will pass through the trust and be distributed to beneficiaries, who are Sealaska shareholders.

Sealaska will initially use the trust as a conduit for shareholder distributions. Distribution amounts will be determined by Sealaska and its board of directors. Sealaska will then transfer the required amount of funds to the trust for distribution. Trust beneficiaries will receive the same amount of distribution as they would have received as shareholders of Sealaska Corporation.

The resolution language says funds may be distributed on a basis other than per-share. What does this mean?

This means that Sealaska could use the trust to pay other shareholder benefits (bereavement and scholarship benefits are two examples). Scholarships are awarded when qualifying shareholders apply, not on a per-share basis. Using the trust as a mechanism to offer other benefit programs at some point in the future may not reduce dividends, as Sealaska will transfer in new funds to cover the expanded benefits, but it does use a distribution formula not solely based on shares. This language has been confusing for some, but we are committed to expanding and improving shareholder benefits and proposed this trust because we believe it will help us do that. There is no immediate plan to change any benefit structure or formula currently in use by Sealaska, and Sealaska has historically been able to stand up important shareholder programs while keeping distributions stable.

What will Sealaska do with unclaimed distributions after five years?

Sealaska will create a process in coordination with trustees to ensure no loss of dividends for shareholders if they face a gap in claiming their dividends, just like Sealaska currently follows. Shareholders do not lose their stock rights if they do not claim dividends for five years and remain beneficiaries of the trust. Shareholders would continue to “earn” distributions, but those that are older than five years would transfer to the trust for distribution to all unit holders.

Latest News

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.