#NativeEnough Discussion Guide

Wednesday, May 25, 2022

Discussing blood quantum with friends and family can be challenging because no matter how you feel about the issue, it often strikes at the very core of who you are or how you would like to be perceived. We believe shareholder-to-shareholder conversations about this issue are critical to deepening understanding.

The following questions are provided to help shareholders discuss the issue. For answers to frequently asked questions about blood quantum and the 2022 Sealaska proxy resolution, please click here or visit the #NativeEnough tab on MySealaska.com.

- Are there circumstances you can think of in which a person with less than one-quarter blood quantum should be able to own shares in Sealaska?

- In your opinion, are there certain actions a person must take or knowledge sets they must have in order to be considered truly Native? If so, what are they? Can you imagine circumstances in which a person might not have access to that information and why? Are there other parts of their experience that would connect them to the experience of Indigeneity, like growing up around other Native American or American Indian tribal communities; studying Native American culture on their own or in school; experiencing bias as a result of their heritage?

- If you are a shareholder, do you feel a sense of connection to homelands as a result of your ownership in Sealaska? Are you aware that of the many organizations associated with Alaska Natives (tribes, tribal health organizations, village corporations, social-service nonprofits, etc.) do not own land? Alaska Native corporations like Sealaska are the only ones in Alaska that own title to ancestral homelands. If you are a descendant, what would share ownership of ancestral homelands mean to you?

- In pre-contact Tlingit, Haida and Tsimshian cultures, belonging in a tribe or clan was established through contributions to the collective and by your family ties. There was no concept akin to blood quantum. In today’s modern world, in which cultures have intermixed and many live far from traditional homelands, how should belonging be established? What are the pros and cons of the various options you can imagine?

- Today, prospective new descendant shareholders in Sealaska are required to document their relationship to an original shareholder. This blood relative must be a parent, grandparent, great-grandparent, etc. (Sisters, brothers, aunts, uncles, step-parents, etc. do not count.) Applicants must provide a date of birth or the last four digits of this relative’s social security number, along with birth certificates or other legal documents establishing their relationship to an original shareholder. These materials are reviewed by enrollment specialists at Sealaska for authenticity and completeness. If the resolution passes, the only thing about this process that will change is that Sealaska will no longer require a Certificate of Degree of Indian Blood (CDIB) from the Bureau of Indian Affairs. Do you feel this verification process is adequate? If you do not, what process would you design in its place?

- Alaska Native corporations and federally recognized tribes can define membership or eligibility however they want under federal law. If the system of blood quantum had never been created, what system would you create to establish belonging in the modern context? If you could start from scratch, what would that look like?

- Sealaska’s business performance has been improving for nearly a decade since a low point in 2013, in which the company experienced negative net income. Since then, net income has grown by nearly $100 million dollars; shareholder benefits have increased; and visionary projects like carbon sequestration have allowed Sealaska to contribute to trusts and endowments that will generate predictable income streams for priority services — including dividends — for decades, if not centuries, to come. How confident are you in Sealaska’s growth trajectory? Do you believe that the company will be able to sustain or improve upon this performance, and how does that impact your thinking about whether adding new shareholders is advisable?

Latest News

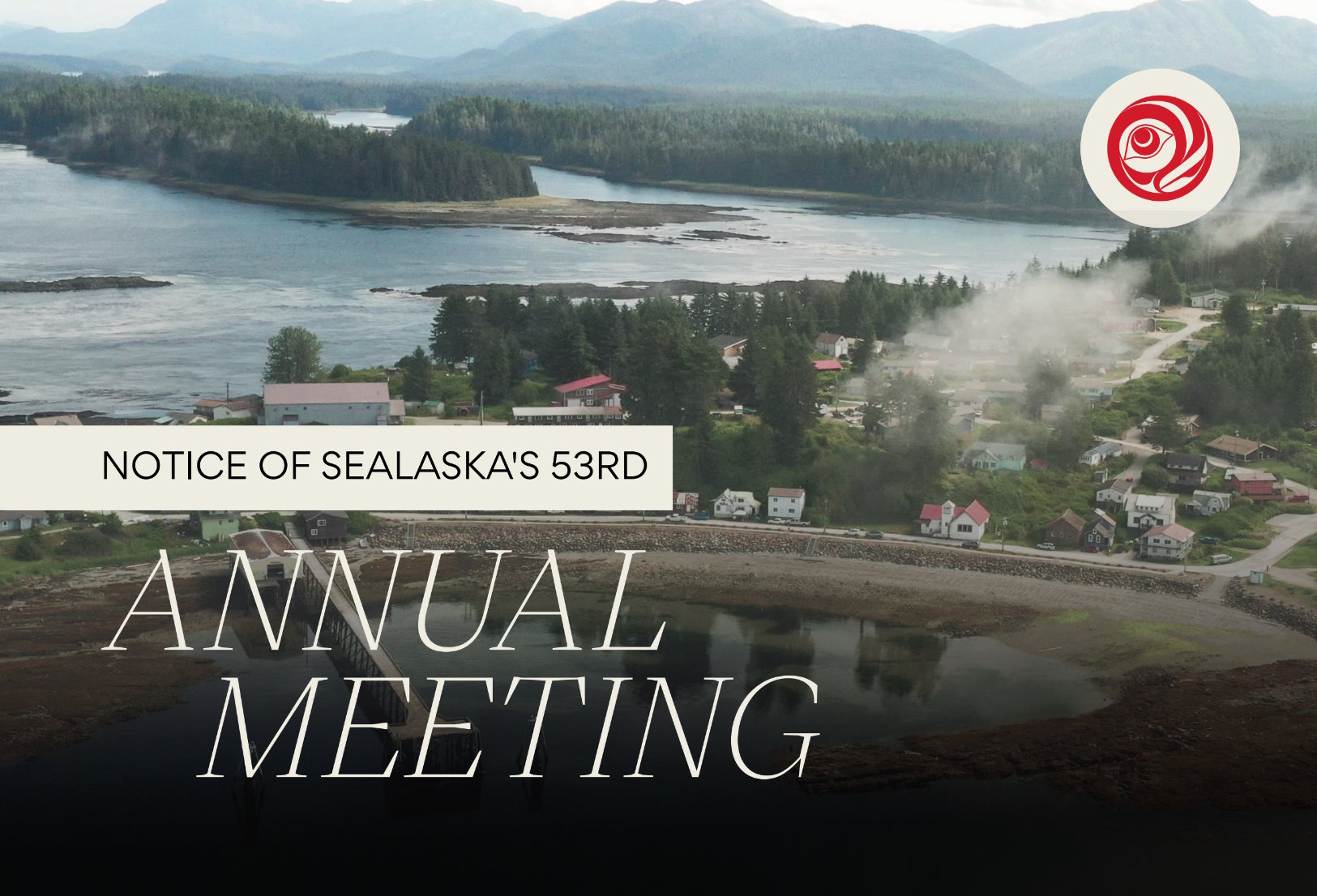

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.