Sealaska board provides fourth quarter, distribution update in virtual session

Friday, November 17, 2023

Sealaska’s quarterly Board Q&A sessions offer shareholders and directors a chance to connect in a casual online environment, empowering shareholders to ask questions directly to the board and providing directors a chance to hear shareholder voices on the issues that are important to them.

On Nov. 7, Sealaska directors provided an update from the November board meeting, held on Nov. 2, as well as information on the fall distribution ahead of its issue date, Nov. 9. Shareholders from around Alaska and across the country participated, asking questions ranging from Sealaska’s shareholder employment to natural resources revenue sharing in the online Q&A session. Shareholders can view previous virtual meetings by visiting the Meeting Archive on MySealaska.com and view the full fourth quarter Q&A session, including the chat, online here.

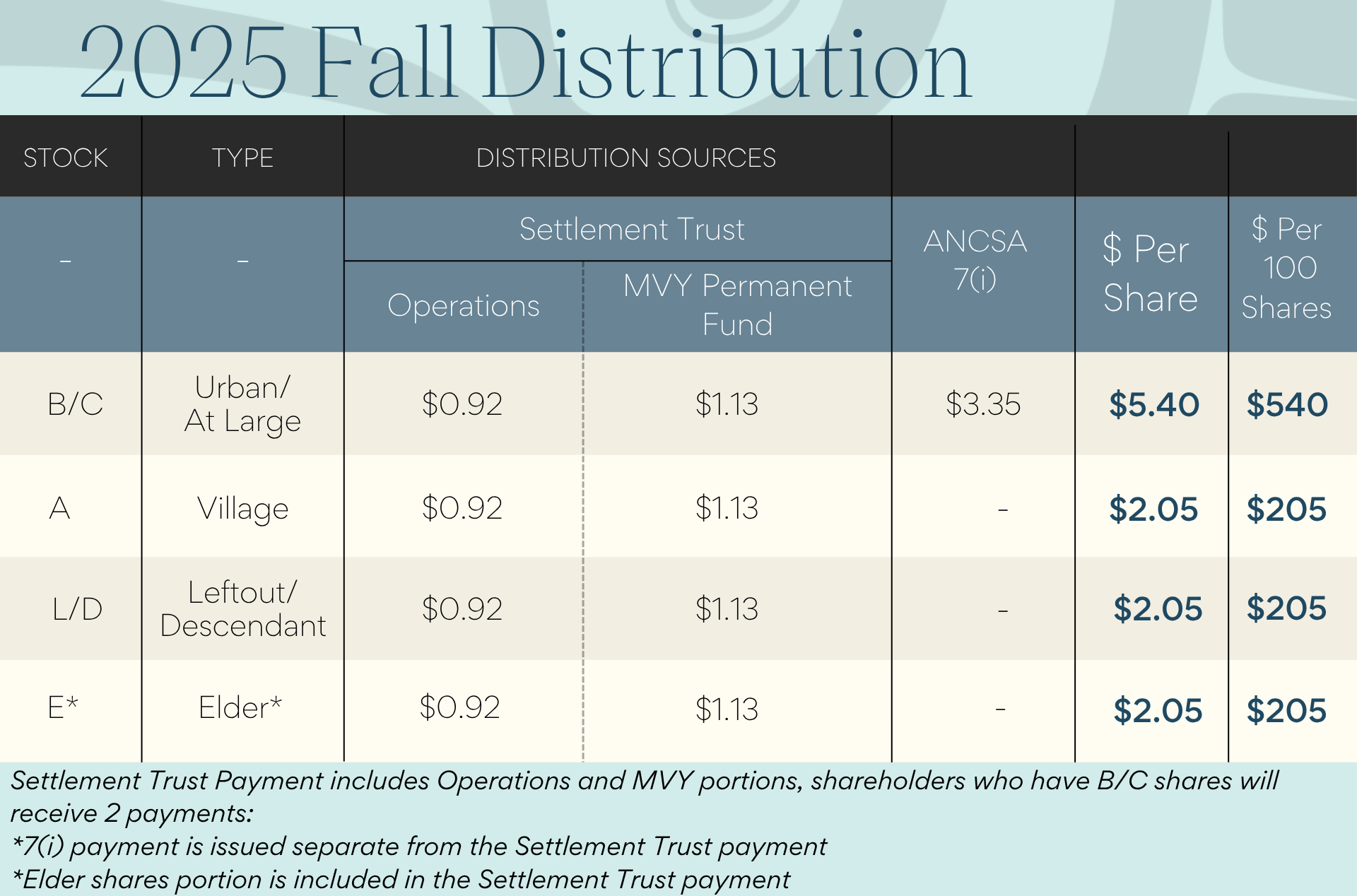

Shareholders voiced diverse perspectives in the chat, including on this fall’s distribution, which was a decrease from the unusually high spring amount. Learn more about how Sealaska’s distributions are calculated and the factors that played into both this fall’s distribution and the spring’s higher-than-usual payment to shareholders. A variety of questions were asked to the board as well, highlighting shareholder priorities, hopes and concerns. Find a list of frequently asked questions from the Q&A session and their associated answers below.

Thank you to the 380 participants that tuned into the event. All online attendees were eligible to win one of five $200 cash prizes.

FAQs based on Shareholder Distribution Q+A livestream on Nov. 7

What level of shareholder hire does Sealaska have?

Sealaska corporate, based in Juneau with offices in Ketchikan, Klawock, and Seattle, has a shareholder hire rate of 82%. We are always seeking to increase the number of shareholders hired at all companies – find exciting opportunities (both close-to-home and global!) with Sealaska here, and sign up for job alerts here to be notified of new opportunities as they arise.

Why was the most recent distribution to shareholders low, and how are distributions determined?

Please see an analysis of the Fall 2023 Distribution available here.

How are Sealaska’s businesses doing, and how do their successes benefit shareholders?

Sealaska’s shift to an ocean-health focused platform continues to be successful. Please see Sealaska’s 2022 annual report – as well as annual reports from previous years – for a snapshot of audited financial statements demonstrating growth. Since 2015, Sealaska has more than tripled the annual amount that has been invested in programs designed to promote the education, economic and cultural benefit of our shareholders. These benefits include scholarships, internships, funding for language revitalization, and contributions to communities to promote economic resilience and cultural vitality. This is in addition to twice-annual distributions.

How is the Sealaska board of directors compensated?

Directors are compensated via a flat meeting fee. Their costs for board associated travel are also paid. Directors do not receive bonuses as part of their compensation. The members of the Board of Directors received a fee of $2,000 per month; the vice chair of the board received an additional $1,000 per month. In addition, each director received $750 for each day of formal board, subsidiary or committee meetings or specified events he or she attended in the corporate interest, or $500 if they attended via telephone. A fee of $250 was paid for any meeting called as an informal teleconference. No director received a bonus or compensation of any kind except as stated herein. When there are multiple meetings on the same day, only a single meeting fee is paid.

When and why do Sealaska executives receive bonuses, and what are the bonus structure requirements?

The Compensation Committee recommends, and the Board approves, Sealaska’s compensation plans. Please see Sealaska’s 2022 annual report for detailed information on executive compensation from the past year. Along with base salary, Sealaska offers at-risk short- and long-term performance-based incentive compensation programs that are designed to drive and reward strong financial performance. The at-risk incentive awards are earned only when predetermined performance goals are achieved and confirmed by the Company’s independent auditors. Bonuses are paid out after the audit and performance reviews have been completed.

What benefits and opportunities are available to shareholders beyond profit and dividends?

Sealaska’s total shareholder benefit structure includes over $30M in benefits between dividends, language revitalization, scholarships, workforce development, elder distributions, advocacy, providing cultural use wood, and bereavement payments. Shareholders can learn more about opportunities with Sealaska at MySealaska.com/Opportunities.

If you missed this Q&A session, we invite you to tune into the next Board Q&A, to be held following January’s board meeting. Look for more information after the holidays.

Latest News

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.