Sealaska Settlement Trust – Your Questions, Answered!

Thursday, May 13, 2021

Why does Sealaska want to establish a new settlement trust?

Why does Sealaska want to establish a new settlement trust?

It’s a great opportunity for Sealaska, and for our shareholders! An Alaska Native Corporation Settlement Trust provides Sealaska and its shareholders with significant tax advantages. Distributions to shareholders (referred to as “beneficiaries” under the trust) will not be subject to federal tax. Changes to federal tax law in 2017 allow Native corporations to make contributions to a settlement trust using pre-tax dollars. This change reduces the federal government’s share of a Native corporation’s income, creating a cash savings that can then be used to fund benefit programs, like distributions.

What is a Settlement Trust?

Under the Alaska Native Claims Settlement Act, Sealaska can set up a special entity called a “Settlement Trust” that is legally separate from the company and dedicated to providing benefits to shareholders and descendants. The purpose of a Settlement Trust is to provide for the health, education, cultural preservation and economic welfare of Alaska Native people and descendants who are the “beneficiaries” of the Settlement Trust. If the shareholders approve establishing the Trust at the upcoming Annual Meeting of Shareholders, instead of Sealaska providing benefits to the shareholders directly, including dividends, Sealaska will transfer assets to the Settlement Trust, which will then provide the benefits to the shareholders. Settlement Trusts are taxed at much lower rates than corporations, which is why creating a Settlement Trust would be beneficial.

Common Terminology Associated with a Settlement Trust

Settlement trusts use different words for many of the concepts you’re familiar with as a shareholder or descendant of Sealaska.

What does “tax-free distributions” mean?

Shareholder distributions using the proposed settlement trust are not subject to federal income tax.

Beneficiaries may still be subject to state tax, however. In Alaska and Washington, where the vast majority of our shareholders reside, there is no personal income tax, so distributions from the settlement trust will be 100% tax free. Elsewhere, distributions could be taxed if the state where you live has personal income tax.

Shareholders of class A, B, and C shares will continue to receive ANCSA Section 7(j) distributions either directly from Sealaska Corporation or their Village Corporation and those amounts will still be taxable.

If I don’t claim my distribution, will I forfeit or lose my Sealaska stock?

If a shareholder does not claim their trust distribution after five years, the money will go back into the trust. The money will then be invested or redistributed to other beneficiaries. It does not dissolve Sealaska stock.

Who will manage the settlement trust?

The settlement trust will be governed by a 13-member board of trustees. The board of trustees will be made up of all 13 members of Sealaska’s Board of Directors. They will not receive any additional compensation for serving as trustees.

How can shareholders influence the trust?

Shareholders’ voices will be heard through Sealaska’s Board of Directors. Because all members of Sealaska’s Board of Directors are also trustees, a vote for a board candidate is a vote for a trustee. Sealaska will continue to survey shareholders on a regular basis to assess your priorities and ensure our benefit programs align with your values and concerns.

Will shareholder benefits change with a settlement trust?

The settlement trust would provide all the same benefits Sealaska shareholders currently receive, and new benefits could be added in the future. Dividend calculations and distributions would not change.

Under the settlement trust, distributions may grow faster because money in a settlement trust is taxed at a lower rate, increasing the amount of money available for shareholder distributions. Because of this tax benefit to Sealaska, the company will also have more money available to make business investments that grow our company and hopefully lead to the availability of greater benefits in the future.

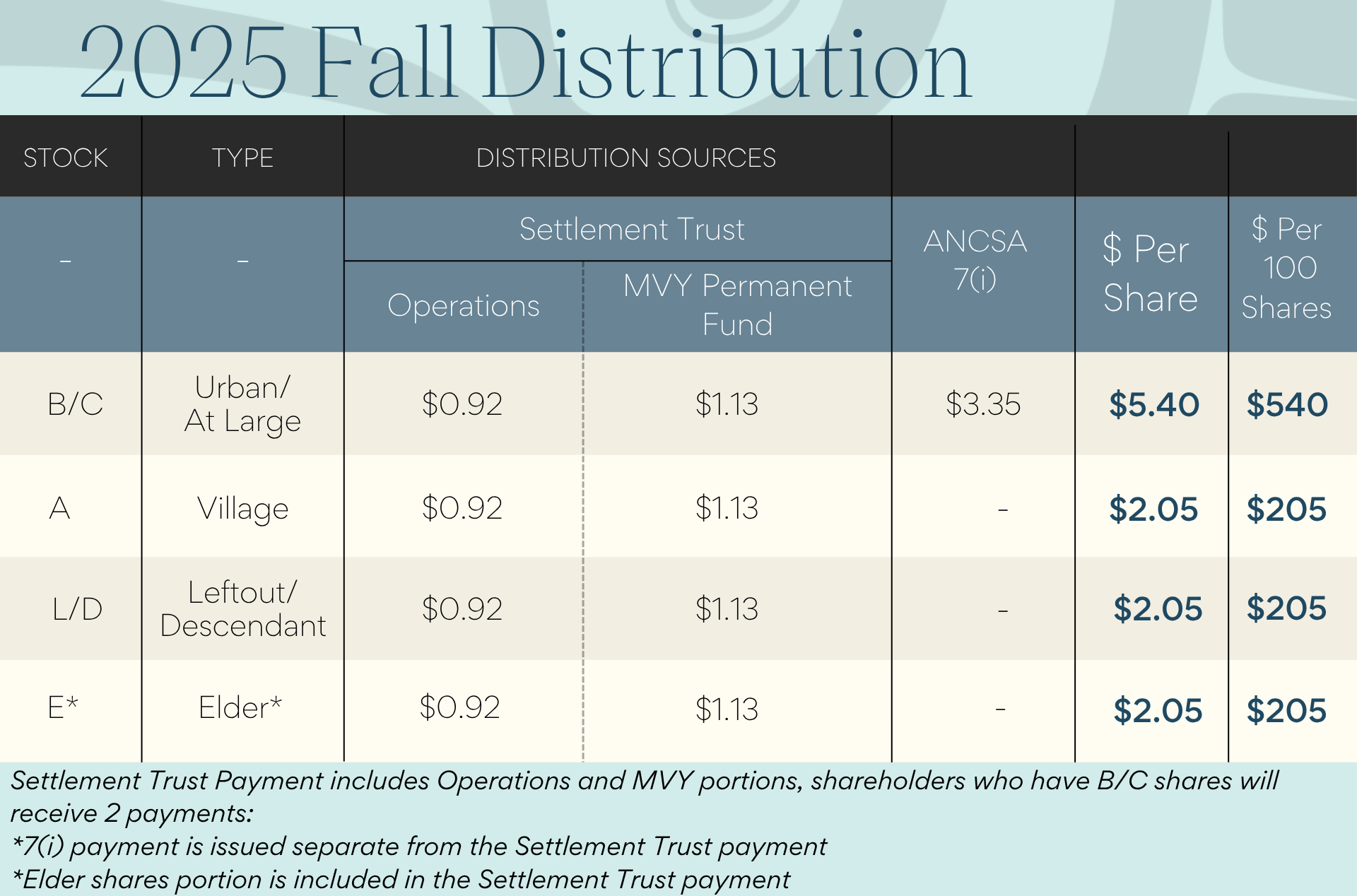

How will shareholders receive distributions from the settlement trust?

Distributions will be paid to shareholders the same way dividends are now. When the board meets in April and October, they decide on the amount of the distribution. Shareholders receive their distribution based on how many shares they own and the class of shares. With the Settlement Trust, the board will vote to send the total distribution amount from Sealaska to the Settlement Trust, and the trust will issue distributions to shareholders. The main difference shareholders will notice is that with the Settlement Trust, shareholders won’t have to pay federal taxes on their distributions.

Will shareholders lose shares with a new settlement trust?

Dividend calculations and distributions will not change. If you have 100 shares of Sealaska stock, you will own 100 units in the Settlement Trust. Your shares in Sealaska will still exist, and can still be gifted or willed as they are now. For example, if you gifted 10 shares of Settlement Common Stock in Sealaska to your grandchild, your grandchild will receive those shares as well as 10 distribution-paying units in the Settlement Trust.

The resolution language says funds may be distributed on a basis other than per-share. What does this mean?

This means that Sealaska could use the trust to pay other shareholder benefits (bereavement and scholarship benefits are two examples). Scholarships are awarded when qualifying shareholders apply, not on a per-share basis. The trust would keep funds for these payments separate from funds used for distributions.

Would combining dividend funds with program funds into one trust reduce the amount of money available for shareholders or programs?

Sealaska will continue to fund programs to benefit shareholders. Approving a settlement trust will not change this.

Is it risky to get Sealaska involved in an unknown venture like settlement trusts?

Settlement trusts are not new. They have been used by Native corporations in Alaska since the late 1980s and have been approved by shareholders of Ahtna Inc., Bering Straits Native Corporation, Calista Corporation, Cook Inlet Region Inc. and NANA Regional Corporation, along with many village corporations in our region, like Goldbelt, Inc., Kootznoowoo, Inc., and Huna Totem.

In fact, Sealaska already has an established Elders’ Settlement Trust for one-time payments to shareholders of Class A, B and C stock when they reach the age of 65.

The relatively new tax law, however, would allow the new settlement trust, proposed on this year’s proxy, to benefit all Sealaska shareholders and descendants year after year.

What is Sealaska’s plan if the trust is not approved?

If shareholders reject this resolution, business will continue as it is now. This means Sealaska will continue to pay a higher tax rate and shareholders will continue to pay income taxes on the dividends they receive. Essentially, this is money going to the federal government instead of into shareholders’ pockets.

How can I learn more about Sealaska’s plan for the settlement trust before the election closes?

CEO Anthony Mallot, Director of Tax and Finance Mark Poplis and others will hold a special “lunch and learn” session on Thursday, May 20 from 12-1 p.m. to discuss the settlement trust and answer shareholders’ questions.

There will be another opportunity to learn about the settlement trust at a virtual community meeting at noon on Saturday, May 22. The event can be viewed at MySealaska.com. A recording of the community meeting will be available on-demand following the live event.

Information also is available in Election Connection on MySealaska.com, in Sealaska newsletters leading up to the election deadline and through discussions with board candidates.

Latest News

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.