Your Questions, Answered: Fall 2021 Sealaska Distribution

Tuesday, October 26, 2021

Sealaska’s fall 2021 distribution will be announced on Friday, Oct. 29. Distributions are just one of many benefits Sealaska provides to shareholders and descendants, including educational and professional development programs like scholarships and internships, semiannual distributions to shareholders, and donating to cultural programs. In 2020, Sealaska paid out more than $28.5 million in shareholder benefits.

Sealaska’s fall 2021 distribution will be announced on Friday, Oct. 29. Distributions are just one of many benefits Sealaska provides to shareholders and descendants, including educational and professional development programs like scholarships and internships, semiannual distributions to shareholders, and donating to cultural programs. In 2020, Sealaska paid out more than $28.5 million in shareholder benefits.

Answers to frequently asked questions about the distribution process and timeline are below. Don’t see the answer you’re looking for? Contact us at corpcomm@Sealaska.com and we’ll track down the information you need.

Q: What is the fall distribution schedule?

- Friday, Oct. 29 Distribution Announced | View pending amount MySealaska.

- Friday, Oct. 29 Record Date | Last day to make changes to stock, gift stock, enroll, process estates or transfer shares.

- Monday, Nov. 8 | Last day to change shareholder banking or mailing information.

- Friday, Nov. 12 | Date of distribution

Q: How are Sealaska distributions calculated?

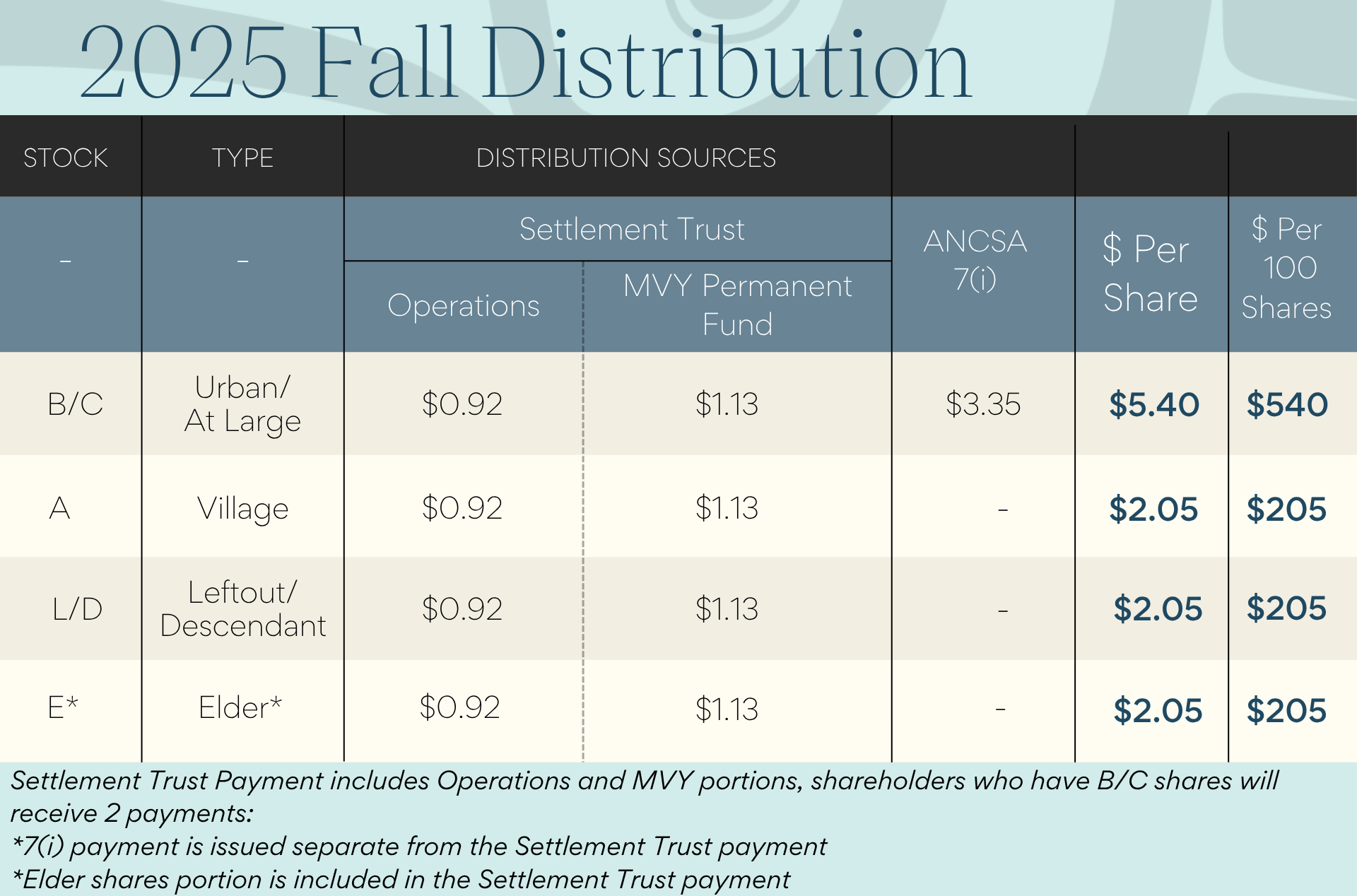

All shareholders (Class A, B, C, D, E, L) receive payments from Sealaska operations as well as a payment from the Marjorie V. Young Shareholder Permanent Fund (MVY). Beginning with the fall 2021 distribution, payments from operations and MVY will pass through the Sealaska Settlement Trust.

Urban and At-Large shareholders (Class B, C) receive an ANSCA Section 7(i) payment as well. This payment will come directly from Sealaska as it always has.

Q: Why do Urban and At-Large shareholders (Class B, C) get additional money?

All shareholders, directly or indirectly, benefit from Section 7(j) of the Alaska Native Claims Settlement Act (ANCSA). ANCSA Section 7(i) requires that all ANCSA corporations share 70% of their revenues from natural resource development with one another. This provision was created in recognition of the fact that some regions have more lucrative natural resources than others. Section 7(j) requires that 50% of the shared resources Sealaska receives from other ANCs is distributed equally between the 10 Southeast village corporations in our region and our Urban (Class B) and At-Large (Class C) shareholders.

Holders of Class B and C stock are not shareholders of village corporations, so they receive their 7(j) payments directly from Sealaska. It is up to the village corporations to decide how to use their ANCSA Section 7(j) payments, which can include dividends or other benefits.

*Class “E” shareholders (Elders) and Class “L” shareholders (Leftouts) do not receive ANCSA Section 7(j) payments.

Why do Descendant and Leftout shareholders receive a smaller amount than other shareholders?

The difference is that they do not receive ANCSA 7(i) payments. Both of these types of shareholder stock, along with Elder stock, were created after ANCSA and are not eligible for ANCSA 7(i) payments.

Q: What is ANCSA Section 7 (i) and (j)?

Under ANCSA the 12 regional corporations share a portion of natural resource revenues. This is known as the ANCSA Section 7(i) revenue sharing agreement. Payments from Section 7(i) are called Section 7(j) payments.

Q: How are ANCSA Section 7 (i) and (j) Payments Made?

- Class A — Under ANCSA, Class A (Village) shareholders do not receive payment. The payment is directed the village corporations in the region, who decide how to use funds.

- Class B — Under ANCSA, Sealaska makes direct payment to shareholder.

- Class C — Under ANCSA, Sealaska makes direct payment to shareholder.

- Class D — Under 2007 shareholder vote, Class D shareholders do not receive payment.

- Class E — Under 2007 shareholder vote, Class E shareholders do not receive payment.

- Class L — Under 2007 shareholder vote, Class L shareholders do not receive payment.

Q: How much is my check?

Sealaska shareholders who have registered with MySealaska.com can view pending payments when a distribution is announced. The fall 2021 announcement will be made on October 29.

Q: Will my distribution payment be lower because of the Settlement Trust?

The Sealaska Settlement Trust will not change the amount of the distribution. The major benefit to shareholders comes from the fact that distributions made via the Sealaska Settlement Trust are not subject to federal income tax. (ANCSA Section 7(j) dividends are still subject to federal tax.)

Q: What will my fall distribution payment look like?

Q: When will shareholders receive a payment through the Settlement Trust?

Shareholders will begin receiving payments through the settlement trust in the fall of 2021. The fall distribution is expected to reach shareholders with direct deposit on November 12; shareholders who receive paper checks will receive them in the mail a week to 10 days later.

Payments from Sealaska operations and the Marjorie V. Young Shareholder Permanent Fund will pass through the settlement trust.

For example, if you receive $100 in payments from operations and MVY, you will receive $100 from the Sealaska Settlement Trust.

Q: Will Sealaska distributions be tax-free?

- Distributions from Sealaska operations and the Marjorie V. Young (MVY) investment fund will be tax free beginning with the fall 2021 distribution, which will be the first to pass through the Sealaska Settlement Trust.

- Sealaska issued a dividend payment in April 2021, prior to shareholder approval of the Sealaska Settlement Trust. The spring 2021 distribution is subject to federal income tax, and shareholders will receive an IRS form 1099 for this payment in early 2022.

- ANSCA Section 7(j) payments to shareholders (Class B, C) have always been and will remain taxable income.

- Urban and At-Large shareholders (class B, C) will receive 1099 tax form for 7(j) payments.

Q: Are distributions a priority for shareholders or Sealaska?

Sealaska shareholders have told us through surveys that dividend payments are important but are not the only major priority. Education, youth opportunities, workforce development and positively impacting our traditional communities are also important.

Q: Why is the ANCSA 7(j) payment low this time?

Commodity pricing is affecting the income of Native corporations, so we are seeing a lower amount go into the natural resource revenue sharing pool.

Q: I use the MySealaska app on my mobile device, but only see one pending distribution amount?

The MySealaska app is no longer supported, and is not available on Google Play and Apple app. The 2021 fall distribution is not displaying properly on the app because it was not designed to display distributions associated with Sealaska’s new settlement trust. If you are still using the app on your mobile device, please note that the phone app has been replaced by the mobile website. Please open a browser on your phone, go to MySealaska.com and log in.

Q: My check is a lot lower than usual. I thought the Sealaska Settlement Trust was supposed to save money. What happened?

The Sealaska Settlement Trust will save shareholders money because distributions made as a result of earnings from Sealaska’s business operations and earnings on its investments will be routed through the trust and will no longer be subject to federal income tax.

If you are a Class B or Class C shareholder, though, you will probably notice that your distribution this fall is lower than normal. This has nothing to do with the Sealaska Settlement Trust. Payments from ANCSA Section 7(j) are down considerably this fall due to the impact the pandemic had on commodities prices like oil, natural gas and certain minerals. Section 7(j) payments come from the natural resources revenue earned by other Alaska Native corporations and shared collectively under ANCSA Section 7(i). With prices for resources produced by other ANCs on the decline, we can expect to see payments from ANCSA Section 7(j) decrease as well.

Latest News

Notice of Sealaska's 53rd Annual Meeting of Shareholders

Pinned - Posted 2/12/2026The 2026 Sealaska Annual Meeting of Shareholders will be held on Saturday, June 27, in Angoon, Alaska. This year’s meeting will take place at the Angoon Elementary Gym, located at 500 Big Dog Salmon Road, Angoon, AK 99820.

Sealaska Welcomes Madeline Soboleff Levy

Posted 2/7/2026Sealaska welcomes Madeline Soboleff Levy as our new Vice President of Policy and Corporate Affairs.

Online Notary Service for Stock Wills

Posted 1/28/2026Sealaska is pleased to welcome Heather Shá xat k’ei Gurko

Posted 12/17/2025Sealaska is pleased to welcome Heather Shá xat k’ei Gurko as our new Director of Shareholder Communications.